A raft of quarterly results, the Xerox split announcement, and a number of medium-sized acquisitions were the main stories last week in the international ICT arena.

At home, it was another quiet week.

Key local news

* Mixed interim numbers from Ellies, with revenue up 27.4% but still in a loss.

* A positive trading update from Adapt IT.

* A mixed trading update from Datatec.

* Deloitte Digital acquired Cape Town-based financial technology services business, Jinja Interactive.

* Net1 UEPS Technologies made an additional investment for the remaining shares in Transact24 that it didn't already own.

* Renewed JSE cautionaries by Blue Label Telecoms and the Huge Group.

Key African news

* The appointment of Jean-Phillipe Barleaza as VP, channel and alliances and general business in EMEA for VMware.

Key international news

Ninety percent of large organisations will have a chief data officer by 2019.

* Cognizant acquired KBACE Technologies, a global consulting and technology services company specialising in cloud strategy, implementation and integration.

* Foxconn Interconnect Technology, a connector and cable harness maker belonging to the Foxconn Group, bought the optical module business unit and related assets of Avago Technologies.

* IBM purchased Resource/Ammirati, a US-based digital marketing and creative agency.

* Rambus acquired UK-based Smart Card Software, a provider of secure mobile payment and ticketing solutions, for £64.7 million.

* Siemens bought CD-adapco, a privately held US engineering software firm, for $1 billion.

* Sony purchased Israel-based Altair Semiconductor, a company that has developed technology to allow small devices such as security alarms and electricity meters to connect to mobile networks. The deal was worth $212 million.

* Total Systems Services acquired Vista Equity Partners' TransFirst for $2.35 billion, in a move designed to expand its services to more than 235 000 small and medium-sized businesses.

* Arista Networks has levelled anti-trust allegations against Cisco Systems, escalating a legal battle begun when Cisco accused the smaller networking equipment company of infringing its patents and copyrights.

* AVX confirms the jury verdict in a patent infringement case against Greatbatch, in which it was found the former had violated the latter's patents.

* Google has filed a patent in the US that describes a 'delivery receptacle' designed to take packages from an 'aerial delivery device' for deposit to a secure location.

* Xerox will split into two, with one of the companies housing Xerox's hardware operations and the other its services business.

* Rovio Entertainment, the maker of hit mobile phone game Angry Birds, will spin off its education business, including a preschool concept and digital learning tools, as part of its restructuring process.

* Axiata and Bharti Airtel on Thursday agreed to merge their operations in Bangladesh, which will create a stronger challenger to the market leader, Grameenphone.

* Excellent quarterly results from Facebook.

* Very good quarterly figures from Alibaba and Mellanox (back in the black).

* Good quarterly numbers from Alliance Data Systems, Amazon, Aspen Technology, AT&T (back in the black), AVX, Cirrus Logic, Juniper Networks (back in the black), LAM Research, PayPal, Silicon Motion, Skyworks Solutions and VMware.

* Satisfactory quarterly results from Apple, Celestica (back in the black), CGI Group, Check Point Software Technologies, Citrix Systems, CommVault Systems, Ericsson, Fair Isaac, KLA-Tencor, Mercury Systems, Microsemi, NTT DoCoMo, PC Connection, Rambus, Rogers Telecommunications, Sage UK, Synaptics, Tessco Technologies and Total Systems Services.

* Satisfactory nine-month figures from Kyocera.

* Satisfactory year-end figures from Holtek Semiconductor and SK Hynix.

* Mediocre quarterly results from ASE, Avnet, Corning, eBay, EMC, LG Display, Microsoft, Polycom, Qualcomm, SanDisk, Seagate Technology and Western Digital.

* Mediocre year-end numbers from Inotera Memories and Nanya Technology.

* Mixed quarterly figures from AudioCodes, with revenue down but back in the black; Bharti Airtel, with revenue up but profit down; Black Box, with revenue down but back in the black; CA Technologies, with revenue down but profit up; DST Systems, with revenue up but profit down; EFI, with revenue up but profit down; Flextronics, with revenue down but profit up; Intersil, with revenue down but profit up; Lockheed Martin's IS&GS Group, with revenue down but profit up; MicroStrategy, with revenue down but profit up; Qlogic, with revenue down but profit up; Samsung Electronics, with revenue up but profit down; Sanmina, with revenue down but profit up; Sony, with revenue down but profit up; Texas Instruments, with revenue down but profit up; Time Warner Cable, with revenue up but profit down; UMC, with revenue down but profit up; Xerox, with revenue down but profit up; and Zhone Technologies, with revenue down but back in the black.

* Very poor quarterly figures from STMicroelectronics and Unisys.

* Quarterly losses from Allegheny Technologies, Applied Micro Circuits, AU Optronics, Bottomline Technologies, Cavium, Cypress Semiconductor, Electronic Arts, Extreme Networks, Fairchild Semiconductor, Fortinet, Hutchison Technology, L-3 Communications, LG Electronics, Macronix International, NetScout Systems, NetSuite, O2Micro International, Quantum, ServiceNow, SGI, Sprint, TeliaSonera and Teradyne.

* The resignation of Fujio Mitarai, president of Canon.

* The appointments of Masaya Maeda as president of Canon; Michel Paulin as CEO of SFR; and Andreas Sch"onenberger as CEO of Salt (ex-Orange Switzerland).

* The death of Marvin Minsky, a pioneer in the field of artificial intelligence.

Research results and predictions

EMEA/Africa:

* PC shipments in EMEA reached 20.8 million units in Q415, an 18.2% decrease year on year, according to IDC. After a strong shipment push of devices under Microsoft's Bing promotion from summer 2014 to January 2015, the focus for hardware manufacturers and their channel partners has been to deplete stock, leading to an 18% contraction for 2015, with 76.3 million PCs shipped in EMEA.

Worldwide:

* The worldwide public cloud services market is projected to grow 16.5% in 2016 to total $204 billion, up from $175 billion in 2015, according to Gartner. The highest growth will come from cloud system infrastructure services, which is projected to grow 38.4% in 2016. Cloud advertising, the largest segment of the global cloud services market, is expected to grow 13.6% in 2016 to reach $90.3 billion.

* Ninety percent of large organisations will have a chief data officer by 2019, according to Gartner.

* Worldwide spending on digital transformation technologies will grow to more than $2.1 billion in 2019, with a compound annual growth rate of 16.8% over the 2014-2019 forecast period, according to IDC.

* Smartphone vendors shipped a total of 399.5 million units in 4Q15, resulting in 5.7% growth when compared to the 377.8 million units shipped in the last quarter of 2014, according to IDC. For the full year, the worldwide smartphone market saw a total of 1 432.9 million units shipped, marking the highest year of shipments on record, up 10.1% from the 1 301.7 million units shipped in 2014.

Stock market changes

* JSE All share index: Up 3.1%

* Nasdaq: Up 0.5%

* NYSE (Dow): Up 2.3%

* S&P 500: Up 1.7%

* FTSE100: Up 3.1%

* DAX: Up 0.3%

* Nikkei225: Up 3.3%

* Hang Seng: Up 3.2%

* Shanghai: Down 6.1%

Look out for

International:

* Further news on the proposed split by Xerox.

South Africa:

* Further Cell C/Blue Label news and new developments regarding the Vodacom/Neotel deal.

Final word

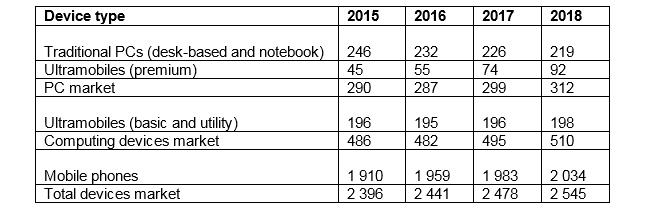

Gartner recently announced its latest device shipment information:

Worldwide devices shipments by device type, 2015-2018 (millions of units)

Notes:

The Ultramobile (premium) category includes devices such as Microsoft's Windows 8, Intel x86 products and Apple's MacBook Air.

The Ultramobile (basic and utility tablets) category includes devices such as, iPad, iPad Mini, Samsung Galaxy Tab S 10.5, Nexus 7 and Acer Iconia Tab 8.

Source: Gartner (January 2016)

Share