Investors looking to cash in on the next big thing will be sorely disappointed if they turn to the JSE, as, for the most part, ICT shares are rather boring and don't offer an entry point to disruptive tech such as Uber.

More recently, growth has slowed down or declined in many instances.

Dobek Pater, Africa Analysis

In the past five years, the JSE has lost 18 ICT-listed companies, according to independent analyst Paul Booth, leaving just 29 such businesses. While some of these companies have been taken over, others have just collapsed.

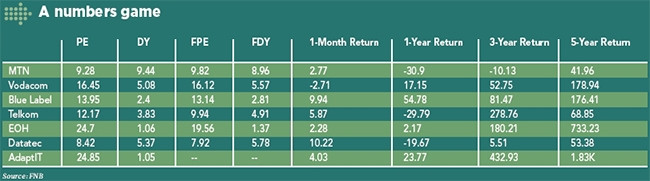

Chantal Marx, investment analyst at FNB Securities, says the past five years have been a mixed bag. "Over a five-year period, almost all of the companies we looked at in the sector performed very well, while over the last year, they didn't do so well.

"Vodacom and Adapt IT did well; MTN, Telkom and Datatec were sold off, and EOH did almost nothing from a share price perspective."

Yet, notes Marx, if one were to take the telecoms and tech market cap values, there has been no value lost over the last five years, although the growth rate of 2.8 percent a year has not been great. However, much of value lost has been in the past year, she notes.

"In the four years to 28 February 2014, ICT shares returned 12.3 percent per annum; 28.4 percent of market cap has been lost over the last 12 months - mostly due to the issues faced by MTN in Nigeria and in part as a result of poor performances by Telkom and Datatec."

Booth notes, however, that most bourses hit peaks in the middle of last year and since then, the ICT index has lost 175 percent of its value as the global stock rout took its toll.

Ovum analyst Richard Hurst puts it like this: "Perhaps we could say that, in general, the performance of the ICT shares has been spotty."

Africa Analysis director Dobek Pater adds that the first part of the current decade saw quicker appreciation in ICT stock value. "More recently, growth has slowed down or declined in many instances."

This, says Pater, could be because of a combination of factors: markets have become more competitive and there are more threats to the established (listed) stocks. In light of this, some stocks may be seen as overvalued, given their potential/anticipated future performance.

Hurst says those investors who want to get into disruptive stocks, with the ability and the know-how, will begin to shift their focus to other jurisdictions, such as Europe and the US to invest in the high-growth, higher-return and less risky ICT stocks.

"Investors will continue to do their research into available opportunities in the South African sectors but, as can be seen, there are no attractive entities such as Apple or even disruptive companies, such as Uber. The core ICT investment opportunities tend to revolve around basic service such as connectivity, with some value-added services on pre-paid solutions and enterprise."

Minnows and giants

Yet, notes IDC analyst Mark Walker, technology stocks generally fare very well if the technology is understood by the market, it has a widespread appeal and is relevant. "When the industry is exciting, the stock gets almost a mythical value, but when reality sets in, the value of the stock becomes more realistic."

Hurst adds that for the average, or retail, investor, the implication is that their choice is limited to a handful of shares with a price that might be out of reach, or they could opt for a more risky, although less costly

ICT share.

Hurst says the ICT share market in South Africa has been a case of minnows and giants.

"One can clearly see that the smaller companies tend to struggle, first off in gaining any meaningful foothold in the market and then, based on this, any meaningful investor attention. However, having said that, in the so-called smaller brackets, there are a few stellar performers, such as Blue Label.

"In terms of the larger entities, we can clearly see that these companies have a commanding view of their markets, and while some haven't held their value entirely, they have presented some trading opportunities."

He adds that there are still some very good value shares among the ICT-listed companies on the JSE.

"Investors will need to look at the fundamentals of the companies and examine issues such as management and strategy. If we look at the best or better performers of the JSE, we will see it is often these entities that have strong leadership, diverse product sets and operate in various geographies other than our home market of South Africa."

What's next?

Hurst notes the price: earnings ratio of stocks - a measure that compares the share price against earnings to determine if the stock is relatively expensive - appear very realistic and, while not as high as other sectors such as pharmaceuticals, they don't seem to be suffering in the same way other sectors like mining and commodities are.

The big question is, where is it all going? Hurst believes the ongoing pressure on the smaller ICT entities will give further momentum to current merger and acquisition activity in the sector.

"Players within the market will look to consolidation as a means of survival, while the larger entities will seek to acquire these entities to tap into niche markets and acquire new IP and skills."

Pater notes the disappearance of value from the bourse in recent years is mostly due to merger and acquisition activity, but also because of companies that have delisted, such as Vox Telecom.

While some of the value stays local, in some cases it moves, such as when NTT bought Dimension Data for R24 billion at the end of 2010. "In cases where companies are acquired by other local listed entities, such as when Telkom bought Business Connexion, the lost value from the delisted share does not necessarily translate into a corresponding value gain by the acquiring entity. This means that overall value is also lost from the market."

Jason Muscat, FNB analyst, adds M&A activity often rises toward the trough of business activity as the valuations are lower and businesses can pick up good companies at a discounted price. "We wouldn't be surprised to see a greater degree of consolidation in the market as well as spinoffs (or sales) of non-core business units."

Pater says merger and acquisition activity is likely to continue due to the competitive environment, although the number of potential listed acquisition targets has been diminishing.

However, he notes, there is always the potential for new stock to list, such as mobile service provider Cell C.

Jose dos Santos, Cell C CEO, has indicated the company could come to the market in the next few years. However, Booth says the pending pipeline of listings isn't very strong.

We live in a world where you are constantly connected via your phone or computer or both, Walker adds. "What that implies is that a lot of the companies that have been offering point solutions to enable that type of connection will grow and their technology will possibly be recognised by a bigger player, prompting these bigger players to acquire the smaller companies to build that specialty into their broader product offering.

"Another scenario is where companies look at their competitors, who may have a better offering, but not necessarily the same marketing muscle and would look to buy them to either incorporate them into their existing offering or shut them down to reduce competition in the market.

"So, effectively, the big fish are eating the smaller fish for two reasons: either for competitive reasons or to improve what they are offering the market," says Walker.

This article was first published in the May 2016 edition of ITWeb Brainstorm magazine. To read more, go to the Brainstorm website.

Share