A fully-live distributed ledger technology (DLT)-based payments system is not currently planned in SA.

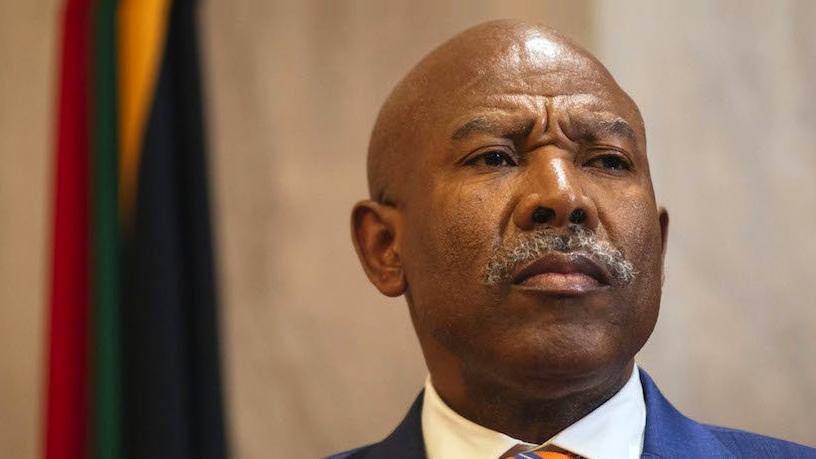

This is according to South African Reserve Bank (SARB) governor Lesetja Kganyago, who spoke yesterday during the launch of the report on Project Khokha in Sandton.

Project Khokha is a proof of concept (POC) designed to simulate a "real-world" trial of a DLT-based wholesale payment system.

The project focused on providing participants with practical experience on aspects of using DLT in a realistic test environment where different deployment models were utilised.

The South African Revenue Service will clarify the tax implications of transacting in crypto-currencies like Bitcoin in either an interpretation or practice this year.

The SARB currently uses the South African Multiple Option Settlement (SAMOS) automated interbank settlement system for banks to settle their obligations on an immediate real-time basis. The Project Khokha POC was not intended to replace the SAMOS system, the central bank says.

It points out that one logical step for adoption, which has been mooted by the Central Bank of Brazil, is to install DLT as backup to the "normal" payments infrastructure.

Distributed ledgers are a family of technologies where participating nodes in a network each update their copy of a common set of data. Blockchains are a type of distributed ledgers where transactions are organised into consecutive groups, or blocks, that are cryptographically secured.

The project commenced in January 2018 and ran for 14 weeks. It is the first project initiated by the recently constituted Fintech Unit in the SARB. The unit was established to review the approach to policy and regulation of crypto-currencies, investigate innovation and innovation accelerators, innovation hubs and regulatory sandboxes, as well as experiment with DLT in interbank clearing and settlement.

Although the project was a success, with Kganyago saying the results show the typical daily volume of the South African payments system could be processed in less than two hours with full confidentiality of transactions and settlement finality, there are no plans to go live imminently.

"This project has laid the foundations for future collaborative work, essential in the blockchain context, and has fulfilled its objective of providing useful insights to all participants," Kganyago noted.

According to the SARB, the report notes there are many issues to consider before the decision to take a DLT-based system into production can be taken.

"Some of these issues relate to practicalities of implementation, but also regulatory factors and to the broader economic impact," Kganyago said. "The future direction will also be influenced by further development of the technology and by central banks and other regulators globally continuing to contribute to this field of knowledge."

The central bank says it anticipates continuing work in this area and expects to continue contributing to the body of work in the DLT-based systems.

Project Khokha involved numerous partners, including a consortium of banks (Absa, Capitec, Discovery Bank, First Rand, Investec, Nedbank and Standard Bank) together with ConsenSys as the technical partner and PwC as support partner.

The central bank says the project has shown it is feasible to process wholesale payments between participants with full visibility of the SARB from an operational perspective.

However, it points out that while DLT is not yet mature, the technology has been subject to a number of projects carried out by central banks.

"The issues adjacent to these systems will vary on a case-by-case basis, and will include integration with other systems, the fundamentals of cyber security, the management of private keys by parties running nodes, and the legal and accounting aspects of incorporating DLT into current structures."

Share