$99 tablets, cheap smartphones, and flaky hardware. The mobile market is in a race to the bottom in its attempt to drive volume and reach broader markets. But, haven't we seen this before? And didn't it fail dismally?

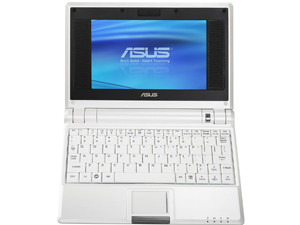

In personal computing, the netbook should have been the pace-setter in that particular race to the bottom, but netbooks had only a scant few years in the sun before the market imploded, with the final nail in the coffin coming at the end of 2012. Consumers simply didn't want the compromises that netbooks required, and better (but more expensive) options won the day.

Now smartphone and tablet vendors are engaged in a similar race, looking to put entry-level devices into the hands of consumers for a fraction of the price of premium products. Rumours are circulating that even Apple, the bastion of premium products without compromise, is considering a cheaper version of its flagship iPhone.

Why should the race to the bottom in smartphones and tablets play out any differently from the ill-fated netbook? Many of the same compromises are being made in mobile devices as they were in netbooks. But the target markets are very different, and while we're in a race downwards, the bottom is still a way off. We will hit bottom, and it will hurt, but not just yet. And when we land, it will probably be Android which takes the brunt of it. Here's why.

Smartphones are not netbooks

Netbooks were doomed from the moment the manufacturers lost focus on the value proposition. As the vendors failed to drive the price differential, or to capitalise on the core advantages netbooks were supposed to offer, the devices ended up no more than crummy underpowered laptops. The bottom of the range rather than a distinct product segment. Suitable only for basic browsing, e-mail, and light media use, and so perfectly positioned to be crushed by sexier tablet alternatives that could do all that and more. There was nothing below a netbook for comparison (apart from not having a computer at all). It was the bottom of the scale, and everything above was better.

In smartphones, on the other hand, there is the vast installed base of feature phones. No matter how bad an entry-level smartphone may be, it is still likely to be superior to a basic phone without any of its advanced features. And while those features may arguably not be all that useful to the mass market of feature phone users, these are frequently sold as aspirational devices, so cheap underpowered smartphones are an important step up the ladder (and a long way up from the bottom rung occupied by netbooks). Although smartphones also have the advantage of access to operator subsidies, that is less relevant to entry-level units sold prepaid than it is to top-tier devices like the iPhone or Galaxy S3.

And while it's the feature-packed top performers which get most of the attention, there's a huge growth in entry-level smartphones too. Although it's a moving target, the bottom may be in sight: a source close to a local importer tells me that Chinese-made Android devices are in negotiation, running Android 4 (ICS) and with attractive form factors, including a five-inch model, but barely capable hardware otherwise. With retail prices expected to be below R2 000 for the larger unit and entry-level models below R600, the appeal for first-time smartphone owners is expected to be tremendous. The compromise in build quality and hardware suggests this is close to a price/performance bottom mark for the time being.

The question is, will reaching the bottom hurt the market, or help it? I'll come back to that after I look at tablets.

Tablets are not netbooks either

Tablets fall somewhere in between. Being a completely new product segment, there's no installed base of inferior technology, but they have the same aspirational appeal as a smartphone.

Amazon's estimated bill of materials for its entry-level Kindle Fire is very close to its $159 selling price, with some teardowns suggesting the company even loses money on it (unlikely, but close). But, via the razor-blade model, the device is not intended to be a once-off purchase. It's the gateway to Amazon's highly profitable media library, and the Kindle Fire is intended to keep the customer locked inside the company's value chain, even to the extent of creating a parallel app store instead of leveraging the larger Google Play store. That's cellphone-subsidy, tablet style, and it's a win-win for all concerned, except Google.

As in smartphones, tablet manufacturers are finding minimum acceptable price/performance levels, which help guide expectations. India's seven-inch Aakash tablet, announced in 2011, was a ridiculously cheap Android tablet at $35. Unfortunately, it was also ridiculously underpowered, and fell flat. The Aakash 2 offers a major performance bump, and still keeps the price under $50, and with the Indian government subsidising the price for students, it's around $20 to users. It's only sold to Indian students, but Datawind, the manufacturer, sells a commercial version, the UbiSlate, for about $80 - that effectively sets a baseline for minimum performance and price. The UbiSlate is by no means a powerful device, but it runs Android 4.0.3 (Ice Cream Sandwich). Chinese manufacturer Scope won a deal to supply 860 000 similar-specced tablets to Thai schools, priced at $81 apiece.

Product milestones throughout the netbook's lifespan

2007: Asus Eee PC netbook Apple iPhone 2008: HTC Dream, first Android device 2010: Apple iPad Windows Phone 7 2011: Nokia abandons Symbian for Windows Phone, launches Lumia Samsung Galaxy Note makes phablet a word 2012: Windows Phone 8 Microsoft Surface

The $99 target for a device with up-to-date software, low-power but capable hardware, and basic connectivity seems a realistic short-term goal, rather than a bottom limit we're racing towards. In that case, where will the bottom really lie? Subsidised seven-inch devices well below the $99 mark, probably from suppliers with a separate profit source like Amazon, are probable. Mid-range hardware with up-to-date software in a nine-inch tablet appears to be hovering around the $120 mark at present; expect that to drop below the $99 line too.

Ultrabook vs netbook... phablet vs tablet?

Meanwhile, the phone/tablet line is blurring rapidly with the emergence of the 'phablet' category. Devices like the Samsung Galaxy Note 2, with its 5.5-inch screen, packed with high-performance hardware and selling for premium prices, offer the size advantage of a small tablet, with none of the compromises. Sounds like an ultrabook, doesn't it? But just as ultrabooks did not really contribute to the demise of the netbook, phablets won't hurt entry-level tablets. Ultrabooks were in a class of their own - almost an order of magnitude more expensive and powerful, with only the size a realistic benchmark for comparison. Phablets are premium devices, and will remain that way.

Once mocked for its not a phone, not a tablet Galaxy Note, Samsung (which wasn't the first, actually - that was Dell's five-inch Streak) has successfully cracked open a niche that is attracting a great deal of attention, with other vendors rushing similar-sized products to market.

If I had to bet on one direction for Apple to expand its product line, it would be a phablet sitting between the iPad Mini and the iPhone, not an iPhone Lite. It can flog previous iPhones to cash-strapped aspirers, after all. Apple didn't follow the netbook trend downwards - it set a new bar for the ultrabook with the Macbook Air. And while Steve Jobs derided small tablets as unviable, Apple under Tim Cook wasn't slow in identifying the growing demand and launching the eight-inch iPad Mini and a larger iPhone. If the phablet market grows as expected, can Apple ignore it?

Hitting the bottom

In all mobile categories, we're some way from the bottom yet, but we're getting close. The question is whether it's good for the market. Being cheap didn't help netbooks. Will it help smartphones?

Price range

From exclusively expensive iPads, the tablet market now covers a range of prices. These are representative samples only - prices and versions fluctuate rapidly. Aakash 2 (Android) $80 Amazon Kindle Fire (Android custom) $160 Google Galaxy Nexus 7 (Android) $200 Acer Aspire One netbook (Windows 7) $230 BlackBerry Playbook $300 iPad Mini $330 iPad 3 $500 Microsoft Surface (Windows 8 RT) $500 Sony Xperia (Android 10") $600 Microsoft Surface (Windows 8 Pro) $900

Does the market even want cheap, below-par hardware? It seems obvious that it does - people like cheap tech. And it's true that sales of cheap hardware spike over holiday seasons like Christmas and the post-Thanksgiving "Black Friday" sales, but so too do the rates of return afterwards, with unhappy customers learning the hard way that you get what you pay for. Sales matter, but so does customer retention.

There's no question that Android is leading the charge here. The OS is cheap for manufacturers (with free licensing and greatly offset development costs), and there's a plethora of component and handset manufacturers - far more than the traditional view of a handful of popular suppliers to Western markets.

Consumers will continue to be exposed to ever cheaper devices. And in theory, free market economics will push poor models to the kerb until we find acceptable minimum standards. In reality, there are some real risks for the manufacturers, and the Android ecosystem in particular.

Managing expectations

A major concern is that users may have unrealistic expectations of devices, since they're all Android devices with little else distinguishing them. Trying to explain to a first-time smartphone or tablet user why his version of Android can't run some apps in the Play Store is frustrating for both sides. Fragmentation is the deeper Android problem here. Not so much for developers as is often claimed - though several versions of the Android OS individually outsell iOS - but for the consumer, who just doesn't know the difference (and shouldn't have to).

There are other issues with that fragmentation. Faced with a flood of malware, Google is working hard to improve the security of Android, but devices with older versions will not benefit, leaving users at risk. Many cheap devices are sold into regions where third-party apps stores are the main source of apps, increasing the risk.

The question is whether disappointment will rub off on the ecosystem as a whole; that cheap products will create disappointed customers who blame the OS, not the underpowered hardware. "Android is rubbish, I'll try an iPad" is a catchier rallying cry than, "I'm not satisfied with the cheap Android tablet that I bought with below-par build quality, insufficient memory and CPU, and an OS build several versions out of date."

To be fair, how should the consumer even know? They know they're buying an Android tablet (though even that's questionable - Apple argued in court that consumers might be misled to thinking they were buying iPads), but do they know the specific point release of Android it's running, and what the difference is between that and other versions? Do they know the hardware requirements, or the difference between different CPU variants? Which apps require which features? Of course they don't.

Paradox of choice

Apple's strategy of maintaining a short list of very specific products is aimed at tackling exactly this confusion. There are very few iPad variants, and you are unlikely to confuse them. There's the little one, the big one, and the high-def one. Pick some storage and connectivity options, and you're done. Apps work ubiquitously.

In retail, the concept of a "paradox of choice" refers to the idea of a buyer with too many options being unable to decide for fear of making the wrong choice, potentially losing a sale to a more smaller and often higher priced set of options, since it is simply a more comfortable choice. Amazon keeps its Kindle range to a manageable size for the same reason.

But our local channels are not ignorant of this. Retailers and service providers choose their products carefully to establish similar options. If anyone will benefit from the short term rush to drop prices, it should be those same retailers, who can choose products which fit against price/performance metrics and which offer reasonable margins.

And margins are where the pain will come when we get to the bottom (in fact, margins will define the bottom), just as it did for the netbook vendors, and it's an area where Apple has an edge, since it'll be the manufacturers, not the retailers, feeling the pinch. Apple's iron grip on its supply chain means that while it no longer leads unit sales in smartphones, it is far more profitable than its competitors. Apple has a lot more room to play with its margin than anyone else.

If the Android market separates into premium, high-margin products, and cheap variants making compromises, that will put pressure on developers, and on Google. Can the ecosystem thrive if advanced apps are restricted to first-class devices? Will we see a cutting point, with an explicit distinction between Android X for low-end devices, and Android Y for high-end, with apps specifically targeted and possibly housed in separate app stores? It's possible - Amazon has effectively done just that.

On the horizon

We won't hit bottom yet. In 2013 and 2014, expect to see prices continue to drop, meaning more choice for consumers, primarily among Android (and derivative) devices.

Manufacturers have an uncomfortable decision to make. Joining the race downwards means risking brand reputation and giving up margin. But ignoring it means watching low-end suppliers grow up and start eating into the high-volume mid-range market.

Apple remains focused on the high end, and Microsoft and its partners are initially focusing on premium customers too, though their marketshare is small enough not to swing the needle either way right now. But if Android's reputation does come under fire, expect to see Microsoft and RIM positioning to take advantage.

Don't discount feature phones yet

And for users, more stratification is likely. There are still market segments where basic feature phones remain the dominant communication tool. No matter how cheap smartphones become, they cannot compete there on price.

The next generation, driven by aspirational purchases of entry-level smartphones among the youth, may see a shift from feature phones (and that is more likely to follow the netbook's market evolution and demise), but that is a technology-using generation away, which means operators and service providers in South Africa and similar markets will still be providing products and services for the users for many years to come.

Share