Mobile devices have revolutionised the entertainment industry by providing new consumption channels. Consumers can enjoy music, games, television, video, gambling, sports updates, personalisation, infotainment and more. This creates a need to understand the factors that will make some service providers more successful than others when offering the services mentioned above.

This calls for radical change on the regulatory policy that controls mobile communication tariffs.

I undertook a study in this regard, with the aim of understanding the factors affecting the usage of consumer mobile services in SA. The study was conducted between May and November 2012 as part of an MBA programme at Wits Business School. I used a quantitative approach to collect data from South African consumers. It was observed that the South African mobile telecommunications market is very mature and close to saturation.

In order to support the many subscribers, the three big mobile operators were found to have invested heavily in infrastructure deployment and data networks. Following the fact that the market had almost reached saturation - which implies a decline in subscriber growth rates, it was observed that regulatory pressures to reduce tariffs could have a serious negative impact on revenue growth and profitability for operators.

However, mobile communication in SA is still one of the most expensive on the African continent, and these prices should be regulated further downwards to make it affordable to the majority of citizens. It is important to factor in the income distribution among its citizens and help ensure only a reasonable portion of income is allocated to mobile communication, giving room for other basic necessities.

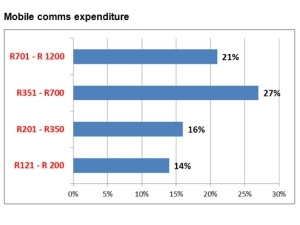

To support this claim, it is sad to note that the following were the observed expenditures from the majority of respondents who participated in this study: 27% spend between R351 and R700; 21% spend between R701 and R1 200; 16% spend between R201 and R350; while 14% spend between R121 and R200.

These figures are quite shocking and interpret to a large percentage of what most South Africans earn. This calls for radical change on the regulatory policy that controls mobile communication tariffs. Of course, this is not a new call, and the situation is exacerbated by the fact that the Independent Communications Authority of SA (ICASA) is ineffective and there is no political will to address this problem.

The following demographics profile was observed from this study. Individuals within the age group of between 18 and 45 years are the key users of consumer mobile entertainment services. However, those within the age group of between 46 and 55 years show the greatest propensity to adopt these services in the future. The most commonly used mobile entertainment service categories are: personalisation, mobile and infotainment services. The study revealed that mobile television, infotainment, mobile video and mobile games show the highest potential for future adoption.

Methodology and sample

For the purpose of this study, the population was defined as any person who uses or would potentially use at least one of the mobile entertainment services provided by any one of the mobile network operators within the borders of South Africa. Stratified random sampling was used, whereby the sample was divided into the mobile network operators they subscribe to. The questionnaires were distributed to network operator service provider stores in Gauteng, and respondents were selected based on whether they were current users of mobile entertainment services or if they intended to use mobile entertainment services. Over 400 respondents participated in the survey.

In line with the above observations, the findings suggest that for a mobile service to be successful, the provider needs to understand that mobile service customers are attracted by five major factors: good access, bandwidth availability and transmission; service availability; content simplicity and appeal; billing integrity; and privacy and ethics. Each of these factors is described below:

High bandwidth availability

It is important to note that poor bandwidth leads to deteriorated access, resulting in a degraded user experience. This affects the adoption of the service in question following poor user experience.

Therefore, there is a need to ensure that users connect to the service with the least (if any) frequency interruption.

Service availability

Customers are quite mobile, and thus, wide network coverage is a key requirement. Therefore, consumers should be able to utilise mobile services from any location.

Content simplicity

On content simplicity and appeal, mobile Internet services must be conveniently placed, easy to subscribe and use, and appealing enough to meet customers' needs and requirements.

This follows the findings that the greater the degree of simplicity related to subscribing and utilising mobile entertainment services, as well as the entertainment and appeal of content, the greater the successful adoption of consumer mobile entertainment services in SA will be.

Billing integrity

There is a need for a greater degree of accurate and transparent billing for mobile services. This will support the increased adoption of mobile entertainment services in the South African consumer market.

Highlights

* Consumers aged between 18 and 45 years are the key users of consumer mobile entertainment services. * Respondents aged between 46 and 55 years are most likely to adopt these services in the future. * The most commonly used mobile entertainment service categories are personalisation, mobile and infotainment services. * Mobile television, infotainment, mobile video and mobile games showed the highest potential for future adoption.

The capability to accurately record, rate and charge mobile entertainment services is a hygiene factor. Service providers should always remember that discrepancies lead to dissatisfaction and frustration, which then stifles adoption.

Billing integrity is one of the matters that need regulator intervention, but unfortunately, the insufficiently funded ICASA has allowed itself to be legally bullied by mobile operators. The problem is that it is the consumers who have to bear the brunt.

Privacy and ethics

The greater the privacy, ethical and moral controls on customer content, the higher the rate of adoption. Illegal access of data on customer usage patterns and unauthorised access of customer accounts should never be allowed, as this data is strictly private and confidential.

In conclusion, the study further observed that SA is culturally diverse, and thus requires diverse services for the various customers. There is also the need for operators to develop campaigns targeted at the age group between 45 and 55 years, since this shows the greatest growth potential.

These campaigns should encompass marketing, customer education and relevant content. They should also concentrate on developing consumer mobile entertainment services for the following categories: mobile television, infotainment, mobile video and mobile gaming, since these hold the greatest potential for future growth and adoption.

Share