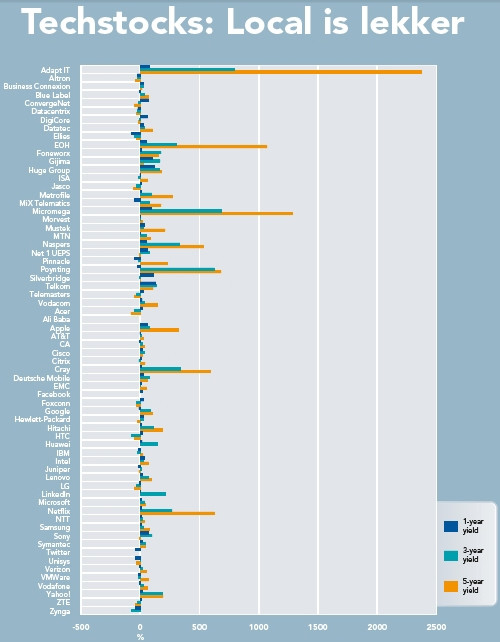

JSE-listed ICT stocks, which have historically been neglected and underestimated as an investment class, have turned out to be better performers than some of their international peers, especially when looked at on a stock-by-stock basis. Although global eyes tend to concentrate on headline hitting shares, such as Facebook, Twitter and - recently - Alibaba, several home players have provided mammoth returns over the past five years. Brainstorm has developed a 29-company ICT index - as this is not currently available via the JSE - and compared the five-, three and one-year gains against 38 of the most obvious international stocks picks, such as household names Twitter, Sony, Facebook and Yahoo!

The results of the calculations show that a basket of JSE-listed ICT stocks - based on an investor buying one share in each company - produce an average return of 261 percent over five years, 126 percent over three years, and 30 percent over one year. The Nasdaq, where most international tech heavyweights have listed, has shown returns of 114 percent, 65 percent and 13 percent respectively over the same period.

Branching out further to include shares listed in other countries such as Japan and the UK, the return comes in at 168 percent over five years, 84 percent over three years and 18 percent over one year. Yet, cautions Vestact analyst Sasha Naryshkine, the devaluation in the rand, which has sunk 42 percent in the last five years, can make local returns less attractive.

Despite the rand volatility, there are still performers on the local bourse that have consistently hit 'home runs', such as

EOH, MTN, Vodacom and Naspers, says Naryshkine.

Betting well

Independent analyst Paul Booth says stripping out the currency effects, the boost in locally listed stocks drops to about 170 percent, putting it on par with Brainstorm's global basket. He says this makes the local bourse a 'good bet', but only when evaluated in rands.

However, argues Chris Gilmour, Absa Investments, the JSE overall generally outperforms other bourses, including the S&P and the FTSE 100, although the volatility of the rand clouds the situation, he notes. "I'm surprised, I didn't realise they (JSE ICT stocks) were that good."

Yet, notes Gilmour, SA's ICT stocks are mostly neglected because they tend to be small caps. He says the shares are 'doing very well', and not just in local terms, but also globally.

Gilmour says the local ICT stocks are 'not justifiably' neglected, but have been left on the sidelines because they're not understood and are small. Yet, he says, the tech sector presents many options and is not just limited to, for example, channel entities as the shares available cover services, software, outsourcing and hardware distribution, among others.

The local bourse has seen many large caps, such as Dimension Data, disappear, having been delisted, says Gilmour. Dimension Data was bought out towards the end of 2010 in a R24.4 billion deal that saw it join Japanese company NTT. Other highprofile shares, such as Vox Telecom, have also left the bourse.

International stocks almost have more of an air of 'respectability' in that they are more predictable.

Among the heavy-hitting performers on the local bourse is Adapt IT, which has gained 2 374 percent over five years, MicroMega improving by 1 285 percent over the same period and EOH, gaining 1 069 percent in the past five years.

Booth notes that holding companies have done better than their peers - such as Adapt IT and MicroMega - but is unsure as to whether this is a quirk. Ovum analyst Richard Hurst adds some of the companies' growth rates raise a 'red flag' as he questions whether this can continue, or will fizzle out.

Companies with a higher geographic presence are returning lower rates of return, while those more focused locally are giving higher returns, notes Booth. In addition, he suspects those companies that have been through 'significant' merger and acquisition activity have probably done worse than others, citing examples such as IBM, Yahoo! and Datatec.

Companies that have proven to be more stable include the likes of Apple, Cisco, Foxconn and HP, which have exhibited less deal-making over the period, says Booth. He notes the same conclusion probably applies to local entities.

Yet, says Booth, there will be exceptions, such as Adapt IT and EOH.

Emerging gains

Hurst says many JSE stocks have a strong exposure to emerging markets, which makes them higher risk, but leads to higher yields. International stocks, however, almost have more of an air of 'respectability' in that they are more predictable.

Local stocks also offer a springboard into Africa - such as MTN - which could allow investors to reap the rewards of an emerging and growing set of economies. Sub-Saharan Africa is currently growing at 4.5 percent, compared to the US, which is gaining at just 2.6 percent. Yet, MTN, over the past five years, returns 86 percent, while Vodacom, which is mostly SA-based, has returned 146 percent. Naspers, which has exposure to China via its Tencent holding, has grown 535 percent in value in the past five years.

Locally, notes Hurst, stocks have not reached the level of convergence seen in international shares, such as Netflix, Twitter and Facebook. He notes this is a 'glaring hole' in the diversity of JSE-listed shares, which provides room for other players.

Booth notes the ICT market sector changes more rapidly than others, and a five-year period in ICT is an 'enormous length of time' while other sectors may only change slightly over five years. "The companies are mostly incredibly different from what they were five years ago."

Overall, says Booth, the ICT sector is too unpredictable and it is difficult to pull out trends. Companies such as Adapt IT, EOH, Huge Group, MicroMega and Naspers are looking good, but "are they peaking out, or being manipulated," he asks. "There is no set pattern, even in a sub sector of the industry itself."

Booth also cautions that companies with overly majority share ownerships, such as Gijima, are susceptible to share price manipulation. He adds investment options are being limited yearly as companies get delisted, and there is a lot of churn, especially in the US where IT stocks are among the leaders when it comes to initial public offerings, but the process is cyclical as they start out, list, and then delist.

Investors have to come down to an individual stock basis, and not generalise, says Booth. He says they need to understand what drives a company, and what plans its CEO has at the moment, as this could change rapidly. How market characteristics will affect stocks depends on what stage of life they're in, Booth adds.

Investors need to be either patient and think long-term, or speculate over a shorter period such as three months to try to catch a wave as the stocks can be very volatile, notes Booth.

This article was first published in Brainstorm magazine. Click here to read the complete article at the Brainstorm website.

Share