The Organisation Undoing Tax Abuse (Outa) has rubbished the latest threats against motorists who continue to default on their e-toll payments.

Last week, the South African National Roads Agency Limited (Sanral) issued yet another warning to motorists who refuse to pay outstanding e-toll bills despite several warnings.

Vusi Mona, GM for communications at Sanral, told ITWeb that failure to pay e-tolls is an offence and motorists who refuse to pay will face "real consequences".

According to Mona, the road agency has prepared approximately 6 500 summonses targeting e-toll defaulters.

He also noted the administrative process by which the issuing of vehicle licence discs is blocked for contravening the National Roads Act "is being finalised now that the court process with the service provider managing the eNatis system has been concluded in court".

However, Outa maintains Sanral's threats are "hollow" and "tantamount to harassment".

The e-tolls opponent has urged motorists to notify it of any instance when their vehicle licence renewals are problematic as a result of unpaid e-tolls.

Wayne Duvenage, chairperson of Outa, says: "These actions would be tantamount to harassment and an infringement of their constitutional rights and a stringent class-action against such coercive tactics may be instituted against the authorities in these instances."

Sky-high bill

Since the introduction of Sanral's electronic toll payment scheme on 3 December 2013, Gauteng motorists have largely remained defiant, choosing to ignore e-toll bills and debt collection efforts.

It was recently reported that Sanral is owed more than R11 billion in outstanding e-toll fees.

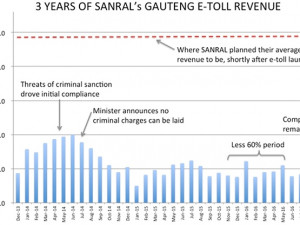

According to Outa, in April 2012, Sanral argued in court that it would achieve 93% compliance levels and would generate average income levels of over R3 billion per annum, or roughly over R260 million per month, of which it would use roughly two-thirds to settle the bonds and one-third (over R1 billion) to pay the collection process managed by Kapsch TrafficCom.

"Our research shows that around the world, these electronic toll payment schemes require compliance levels well upward of 80% in order to succeed," says Duvenage.

"At best and only after the multimillion-rand marketing campaign which threatened motorists with criminal records, the scheme was able to achieve around 40% compliance levels at R120 million per month by mid-2014. Today, that level has dropped to below 18% and around R60 million per month."

From this week, Sanral's e-toll debt begins to prescribe at a rate of around R10 million per day and Sanral will now have no choice but to write off this debt, which has been reported as a collectable asset in its financial statements to date.

Share