This week we were treated to Apple's much-anticipated launch of the iPad Mini. It's a great-looking device, and it'll sell well. But the circumstances of the launch, in context, are where it gets interesting. Apple's leadership position is looking precarious, and the arrival of the Mini (in particular, the manner of its arrival), didn't help at all.

The iPad Mini is entering a much more aggressive competitive arena. There are numerous incumbents, many if not most with technical advantages over the newcomer. Outside of the Mini's specific niche, the tablet market is also no longer a one-horse race - the Mini has to face the double-whammy of entering a fiercely contested niche in a tough market.

Under the covers

A quick roundup of the Mini's vital statistics: it's a 7.9-inch device, powered by Apple's A5 processor, offering a 1 024x768 screen, in 16/32/64Gb and WiFi/LTE versions, priced from $329 to $659.

If that was the full summation of the device, it should be dead on arrival. Every single spec in that list, frankly, sucks. Happily, that's not all it has going for it: it's an iPad, which means it has other advantages. The enormous app ecosystem, for one. The droves of loyal Apple fans, for another. And the excellent iOS operating system and user interface.

Before you roast me for dissing the Mini's specs, look at them in context. And not just against incumbents, but against Apple's own line-up.

7.9-inch? Well, that puts it squarely in the middle of the road. The primary competitors range from 7-inch (Google's Nexus, Amazon's Kindle Fire, Samsung Galaxy Tab, etc) to 7.7-inch (Galaxy Tab) to 8.9-inch (Kindle Fire HD, Galaxy Tab). Its A5 processor is two full generations behind its own stable-mate - the iPad 2 has that processor. The new iPad's A6 processor has been updated to the A6X (boosting graphic performance). The only competitive product with as lousy a screen resolution is the bottom-end Kindle Fire. Every other competitor is either marginally better at 1 280x800, or way better at 1 920x1 200. It has four times fewer pixels than the flagship third- and fourth-generation iPad. Even the iPod Touch has a Retina display. (We have to assume a Retina version of the Mini will be forthcoming.)

Lastly, the price. Lots of analysts thought at $250, the iPad Mini would kick its competitor's collective butts. Instead, it's come in at fully double the price of the bottom-spec Kindle Fire (though seriously, that's not a competitor). More worrying, it's substantially more expensive than Google's Nexus 7, which is very definitely a contender, and on a par with the Kindle Fire HD, which has a screen competitive with the Retina, not the Mini.

In fact, pretty much the only no-brainer competitive loser here is the iPad 2. Against anything else, the iPad Mini will have to fight - and fight hard - to come out on top, relying on its family advantages rather than its own features.

It's going to win lots of those fights, though. Let's be clear about one thing: the iPad Mini is almost certainly going to sell like hotcakes. It looks like a great device despite a couple of shortcomings (which approximately sums up nearly every Apple consumer launch), and it has a devoted fan base and strong app and developer ecosystems. The market is getting tougher, but Apple still has a major competitive edge. For now.

Market forces

Let's look at both parts of that statement - Apple's competitive edge, and the "for now" part, and how the launch of the iPad Mini highlights shifts in the balance of power.

Apple has effectively owned the tablet market ever since launching the iPad 1 in 2010, just as it dominated the smartphone market after the iPhone's debut in 2007. With singular masterstrokes, it rewrote the rules and forced established industries into defensive positions in games they didn't understand. Nokia and RIM are case studies in how quickly those sudden shifts can hurt players who thought themselves invulnerable.

Could the same thing happen to Apple? Is the iPad Mini, in fact, a sign of that in action? Yes and no, I think. It's highly likely Apple, like all tech giants, can and probably will be ambushed by unexpected innovation. The IBM PC demolished Apple once, after all. (The days of Apple humbly, cap in hand, accepting a Microsoft bailout are still fresh in some memories.) The iPad Mini is not a sign of an impending fall, but look closely at it in context, and there are some illuminating signs of how the marketplace is changing, and not all in Apple's favour.

Market share

Apple's tablet market share has dropped rapidly in the last year, and will probably drop further. From near ownership of the market in pre-Android days, it stabilised at about 80% in 2011, before dropping to just over 50% this year (according to Pew Research). But that doesn't suggest there's trouble in Cupertino - Apple is still selling record numbers of iPads every quarter, and will likely continue to do so with the fourth-generation iPad and the iPad Mini. No, Apple's percentage share of the pie is shrinking because the pie is growing so fast, not because it is losing customers.

Next up will be the entrance of Microsoft's tablet play, with Windows 8. This is a major roll of the dice for Redmond, and it might just work. There are a lot of variables - assuming Microsoft gains traction for Windows 8, and assuming the tablets sell, it seems more likely that the pie will grow still further than claiming market share from the entrenched players. And of those, Android OEMs look more vulnerable than Apple. It's unlikely the Apple board is losing too much sleep over Microsoft just yet.

The most likely result is that the pie will keep growing. The tablet market is now cannibalising other markets, as widely predicted. PC sales, already in the doldrums, are now actively in decline. Netbook shipments were already shrinking rapidly, and competent PC-replacement tablets such as the Asus Transformer and Microsoft's Surface tablet are only going to hasten that decline.

Rules of the game

What the market share adjustments do reveal, however, is that Apple is no longer writing the rules of the game. It dominated the market from inception until now, no question, but Android's gradual growth suddenly spiked last year, as the low-end of the market blew open.

Amazon came from nowhere to occupy 21% of the market in the space of a year. The Kindle Fire, ranging from the cheap 7-inch version to the much more capable HD versions, cut straight to the heart of a key market for tablets: media consumption. In some ways, the Kindle Fire is as much of a threat to the greater Android ecosystem as it is to Apple, with its segregated store and one-way Android customisations. But Apple execs have been singling out the low-end version for comparison, and you don't do that to something which doesn't pose a threat.

Apples to oranges

When Phil Schiller, Apple's senior VP of worldwide marketing, took to the stage, he was careful to pick out some narrowly-defined competitive advantages for Apple's new baby. It has a third more screen real estate than a 7-inch tablet, he explained over the course of several slides. That's an odd argument to be making, with the iPad Mini in a market duking it out with not only smaller 7-inch tablets, but 8.9-inch models in the very same Kindle range. It's not a comparison which stands up to deep analysis either: both the 7-inch and 8.9-inch Kindle Fire HD units enjoy superior screen resolution and pixel density to the iPad Mini, and are considerably cheaper. It's not like there aren't almost identical size units, too: I'm sure Schiller knows about Samsung's 7.7-inch Galaxy Tab.

Schiller also showed how the iPad's 4:3 screen ratio is better for Web browsing versus the 16:9 widescreen format of other tablets. Technically he's right, though he hammed it up by including browser tab bars and other on-screen components in the screen of his victim. He glossed over the fact that the iPad's format is inferior for media consumption - widescreen videos will be letterboxed, an issue more important in smaller tablets than larger units. If you assume most users use tablets for casual browsing and watching movies, then one of two sectors of potential customers is losing out.

The reality is Schiller had no choice. Apple was strategically committed to the screen resolution (and therefore its ratio). Doing so was a vital strategic move for Apple and its customers - matching the iPad Mini's screen resolution to that of its older brothers meant the device inherited the entire ecosystem of apps written for that size display. The only other option would have been to adopt the iPhone 5 and iPod Touch's 1 136x640 resolution, something I'm sure was debated, but probably discarded in favour of the existing ecosystem. And since this is really a fight about ecosystems not hardware, it's going to work, so Apple really didn't have to sweat the tech specs. Doing so made the launch look weaker, not stronger. The Mini should sell on its own merits, not due to badmouthing cherry-picked competitor specs. Not when you're vulnerable to the same tactic.

About that screen

The significance of all this goes beyond just the pixels. The ecosystem matters, and this changes things.

The app advantage of screen parity with older iPads was potentially big, but how much did it really matter? The iPhone 5 broke tradition with its tall skinny screen, and it's going to sell well despite its new screen handling existing apps inelegantly. Presumably, so would the iPad Mini. And with developers already building apps for the longer iPhone, the iPad would inherit plenty of new apps. In fact, the opposite is true: newly written apps aren't going to back-port well unless they check for the device capabilities and adapt accordingly. That's easy enough, but it's also an overhead where Apple developers have enjoyed the upper hand over their Android counterparts for some time, with Android devs having to handle the wide range of size and shape Android devices on the market.

So why does this matter? Because it's a step back - a small step, but still a step - from a development competitive edge Apple had owned for several generations of devices. Support for varying size screens is a feature, not a bug, but it's symptomatic of how the separation between ecosystem camps is narrowing. It's just one change, but in context, it rings a bell. The same bell rang when Apple stretched the screen of the iPhone.

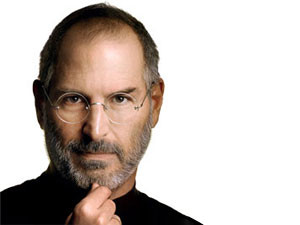

But he said

Steve Jobs had something of a track record for naming products Apple won't make, then making them, and Schiller inherited that legacy. (Don't read too much into it - it's just good business sense. You don't want to draw attention to a gap in your product roadmap before you fill it, and it's certainly laudable to change direction for strategic gain.) Jobs said, for example, that Apple wouldn't make tablets at all. "It turns out people want keyboards," he said in 2003. "We look at tablets and we think they are going to fail." He also said the company wouldn't make cellphones.

Jobs's defenders suggest, with some merit, that he meant traditional tablets - notebook computers with rotating screens which folded flat, a product "innovation" which resulted in heavy, cumbersome devices with at best primitive OS support for touch (well, stylus) interfaces. It would be charitable to say they didn't sell very well. Apple, when it entered the market seven years after his pronouncement, remade the concept in its image and triggered a blindsiding extinction event for the dinosaur tablet PCs.

There's a parallel for 7-inch tablets: Jobs famously launched into a scathing attack on small tablets in 2010, suggesting they should ship with sandpaper so users could sand their fingers down to make them usable.

Here's the difference: from Jobs's tablet denial to the iPad was a generational seven-year gap, and the product was a complete reinvention of the status quo with huge technical leads in many areas. From denial to 7-inch tablet? Two years, and the result is a near clone of several entrenched players, with an offering which is arguably inferior in some ways.

This marks a milestone for some observers, myself included. For years, Apple's consumer launches have redefined markets and forced entire industries to follow suit. Sure, the company didn't invent the MP3 player, or the touch-screen phone, or the tablet. But it got them right, and deservedly became the world's richest company as a result. Not every product launch has been as revolutionary as the first iPhone, but the company has remained fixated on its vision and product direction. The iPad Mini, although it will almost certainly be another success story, marks the first time in many years that we've seen Apple in defensive retreat, having to scramble to catch up to get back on trend.

On its own, that might not matter. The Mini will sell, and Apple will probably deliver an upgrade version with a Retina display in time, re-establishing its position at the top of the heap. But where Apple has spent the last several years annually rewriting the rulebook and making competitors dance to its tune, the playing field is suddenly much more level.

Winners and losers

The winners here are the consumers. In the space of just a handful of years, we've gone from nigh-unusable tablets to sexy devices approaching PCs in capability, with high-def screens, gigantic storage, and prices dropping through the floor. It feels like reliving the heydays of the PC era.

There is one blot on the landscape, and that's the courtroom, which is going to have unpredictable implications for the iPad Mini and every other tablet on the market. The big players, notably Apple, Samsung and Google, have turned an exciting competitive technology sector into one afloat on a sea of bile. Consumers are the winners in the race for features and innovation, but the losers in the patent war. This year, the major players spent more on patents than on R&D. Prices are going up, innovation is stifled, products are delayed or banned. (Watch this space for an upcoming in-depth look at the patent tangle.)

But leave the litigation aside, and the iPad Mini's entrance is a chapter in a fascinating story which is reinventing the way millions of people compute, interact and engage with technology and media. It also happens to be a chapter in which the plot is turning and Apple, the hero from the first page (or anti-hero, depending on your allegiance), finds itself navigating treacherous waters.

Share