The insurance industry is facing stiff competition from emerging insurtech start-ups that are looking to disrupt the market. With the recent integration of technologies like artificial intelligence and blockchain into the insurance market, the sector is gradually being forced to rethink its model.

Local insurance start-up Naked Insurance launched its AI-based car insurance offering this week, which the firm says aims to ensure a fair and transparent insurance process for customers, put customers in control of their insurance experience, and use AI and automation to lower costs.

Alex Thomson, co-founder of Naked Insurance, says the company is built from the ground up by internal developers using AI technology, with the aim of transforming how customers experience insurance online.

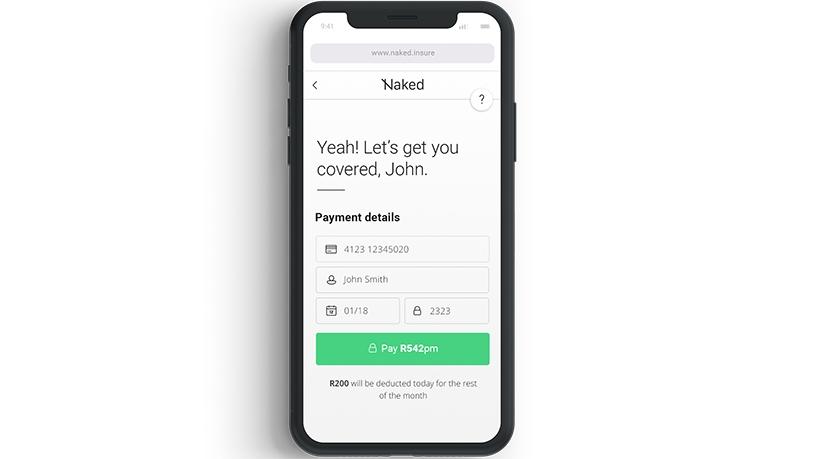

"Potential customers can receive a quote, and if it's accepted, receive cover on the Naked Web site or mobile app, without the need to talk to a call centre.

"The app also allows customers to change or pause their cover at any time through the Naked CoverPause, a world-first for car insurance which gives customers the ability to pause their accident cover if the car won't be used for a day or more - reducing the premium for that time. The pro-rata amount will then be returned to the credit card account."

Co-founder Sumarie Greybe adds that the notion of automating the entire process removes the need for inefficient and costly business processes such as call centre sales.

"This will result in cost savings and ultimately lower premiums for customers. AI-based fraud algorithms permit certain claims to be approved instantly, while other claims - if needs be - will be investigated further. Our fraud detection mechanism includes being connected to other databases such as TransUnion and ENatis to validate various information."

According to the 2017 Global Insurance Distribution and Marketing Consumer Study from Accenture, consumers are open to purchasing insurance cover from non-insurers. This, according to the report, underscores the potential for non-traditional service providers to work with entrepreneurs to drive the evolution of the insurtech landscape.

Similarly, research by PwC shows that nine out of 10 insurance companies fear losing business to insurtech start-ups, but that the majority recognise that co-operation between innovators and backers with capital and an established network have the power to revolutionise the industry.

Earlier this month entrepreneurs Jowyk Muller, Kosie Jansen van Rensburg and Jacques de Waal launched an insurtech start-up called Hero Life. The product is a life insurance offering particularly for young parents.

"We offer an upfront fixed term of five years that they will help you extend and expand when you need to at the best price. Online signup and an upfront price create a great user experience with no medicals or paperwork.

"We also offer clients the opportunity to bypass brokers and call centres and rather offer direct communication channels between business and clients. We want to provide simple, quality cover that most people need at a great price due to our efficiencies and business model. More importantly, we want to empower our clients to be in control of the process and their money, so that they can protect their families without it costing a fortune," explained Muller.

Co-founder De Waal adds that the industry is ripe for disruption at the moment.

"There is absolutely no reason why we can't get a piece of that cake. Tech giants such as Apple, AirBnB, Amazon and Uber have set the tone for insurtech start-ups, with consumers becoming more tech savvy, shifting customer expectations in all industries.

"Insurtech allows us to get closer to customers so that we can meet their expectations. It offers agility, speed, creativity, digital know-how and insights, so that we can be responsive to what customers really need."

Share