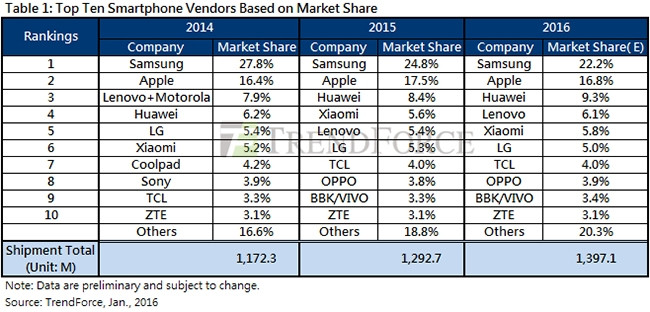

Chinese smartphone brands made a significant improvement in sales worldwide in 2015. Their market share reached a new high of over 40% and their combined annual shipments grew above the global average.

This is according to the latest report from the global market research firm TrendForce, which revealed global smartphone shipments for 2015 grew 10.3% year on year to 1.293 billion units, among which 539 million units came from Chinese vendors.

Huawei in particular surpassed Lenovo for the first time to become the No 3 vendor globally and the leading vendor in China. Chinese smartphone makers also took seven of the top ten spots in the 2015 worldwide vendor ranking.

TrendForce smartphone analyst Avril Wu said: "Chinese vendors together shipped 539 million units in 2015, while Samsung and Apple together shipped a total of 547 million units. Collectively, Chinese vendors were in a close match against the top two global brands."

A Gartner research study focusing on mobile sales for the third quarter of 2015 revealed Huawei recorded the highest growth in mobile phone and smartphone sales. Continued demand for affordable smartphones in emerging markets drove worldwide sales of smartphones.

Anshul Gupta, research director at Gartner, says: "Smartphone sales in emerging markets rose to 259.7 million in the third quarter of 2015 - an 18.4% growth from the third quarter of 2014."

Gupta says in the third quarter of 2015, Samsung refreshed its flagship devices just four months after its previous refresh in order to address slowing demand for its high-end devices, and further compete with Apple's large-screen iPhones.

According to a recent Reuters report, analysts say it is too early to say if Huawei could become a serious rival to Samsung and Apple, as smaller Chinese players such as Xiaomi and Lenovo have often swapped rank in price wars.

"In China it's true that Huawei grew tremendously over the past six months, but it's a bit of a dog fight within the Android ecosystem," says Kantar Worldpanel ComTech analyst Carolina Milanesi.

"Huawei's going after Xiaomi and all the other smaller Android players."

In 2016, TrendForce predicts Chinese vendors will take around 45% of the global market share, with their shipments exceeding the combined shipments of Samsung and Apple.

Wu says this means that nearly one out of two smartphones sold by the top ten vendors this year will come from a Chinese brand. In sum, major international vendors are now facing a tougher market situation.

Further findings revealed Samsung suffered its first-ever annual shipment decline in 2015 while Apple still shines with stellar results.

According to TrendForce's data, Samsung smartphone shipments for 2015 were 320 million units in total. This figure represented an annual decline of 1.8%, a historic first for the South Korean vendor.

Apple retained its position as the No 2 global vendor in 2015 with 227 million iPhones shipped, translating to an annual growth of 17.7% and a 17.5% worldwide market share. Strong sales of iPhone 6 and 6 Plus were a major factor behind the sustained expansion in shipments.

LG's smartphone shipments for 2015 were average compared with the impressive results it produced in 2014. Sales of G4, the vendor's flagship, have been disappointing since its release in the first half of 2015 because the model's specs are too similar to its predecessor G3.

Lenovo's smartphone shipments surged in 2014 to almost 92 million units on account of its acquisition of Motorola's smartphone unit. However, the vendor's shipments for 2015 are estimated to be around 70 million units, which also amount to a year-on-year drop of nearly 24%.

Share