We all agree South Africa needs both economic growth and job creation. With data science's (and artificial intelligence's) ability to replicate human workers, on the surface it sounds like this capability will bring about outcomes contrary to these priorities.

But, not if data solutions are used to scale organisations. If South African organisations can do this, they will serve markets cost-effectively in South Africa and beyond, and broaden financial inclusion.

To get started, we provide four practical steps to take.

1. Start by understanding what data science solutions can do

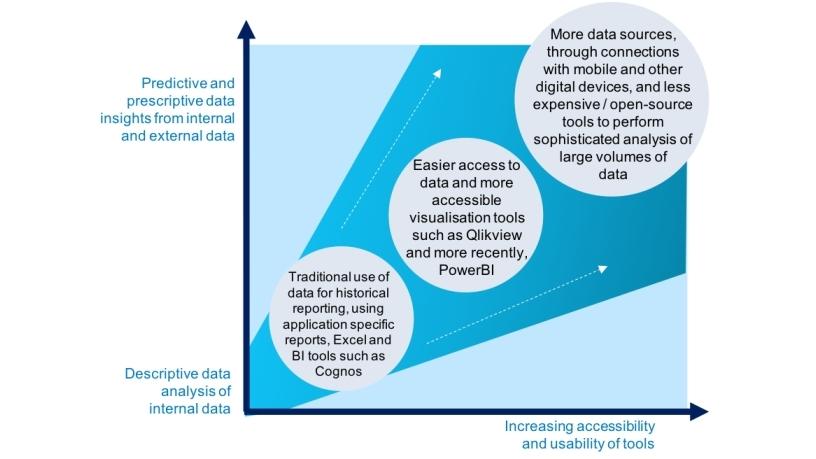

Advanced analytics is not new, and data is certainly not new. What is new is the greater availability and variety of data combined with more accessible data science tools. This means employees beyond specialist actuaries and statisticians (with some proficiency in statistics or mathematics) can explore data for insights using more advanced tools.

More 'intelligent data solutions' provide insights to:

* Support better decisions, eg, selecting which customers to target which marketing campaigns;

* Execute processes faster or better, eg, automated credit decisions; and

* Enhance the customer experience, eg, personal financial analysis solutions to help intermediaries provide better advice to their customers.

2. Identify solutions to reduce the cost-to-serve and scale the business

In price-sensitive markets such as South Africa and in the rest of Africa, cost-to-serve is a key metric to target for reduction. This means growing the customer base with a less than proportionate increase in costs. If a financial adviser, for instance, can serve more customers by providing some of their advice and support through intelligent data-enabled solutions, and not increase support staff, then the cost-to-serve each customer will reduce. Some of the efficiency gains can be passed on to their customers.

3. Overcome the trust challenge

The biggest challenge is for customers and business users who don't understand statistics and data science to trust data insights. The most sophisticated algorithm that provides financial advice won't get used if the users think it is designed to sell them specific products or if it doesn't consider tax implications, for instance. For customers in particular, scepticism of the intentions of large organisations has been exacerbated by the misuse of data by Facebook and Cambridge Analytica.

One of the main causes of lack of trust is the poor quality of data that is prevalent in many financial services organisations in South Africa. A common problem is the identification of customers across different channels and duplicate customer data in different systems.

To fix this problem requires the co-operation of many functions in the business and usually requires interaction with customers and other external sources of data. But this enterprise problem will not be solved quickly. The starting point is to build credibility by extracting insights from whatever data there is to demonstrate value, using the insights to support decisions and activities first rather than to replace humans. And then complementing the data with additional sources.

A longer-term solution may well need to be an enterprise data programme, but this is a complex and costly undertaking.

4. Assign business leaders to key data science projects

Expert data science teams have a passion to develop highly accurate algorithms. Deployment tends to be an after-thought, and integration with business processes tends to be left to a production team or forgotten. For instance, the team may develop a sophisticated model to recommend a suitable product or service to a customer. If that model is to be used by a call centre, the agents not only need to understand the model output but also have easy access when on a call to the customer. That requires integration with the activities of a call centre agent in addition to integration with call centre technology (telephony, CRM systems, etc).

To avoid this execution challenge, assign a 'data science business consultant' to business leaders for key data science projects to identify the business use cases and align these to KPIs and other success measures. Once value has been delivered, use the lessons learned to scale with excellence rather than employing capacity. Data science skills are scarce and a lack of success will drive away the talent required.

Does your organisation know how to capitalise on the insights inherent in your data?

BSG has the knowledge and experience to support you to maximise the business value of your data.

For over two decades, BSG continues to help its clients solve their most important problems. Following a data-led approach, underpinned by strategy execution, BSG can support you to solve your most important problems.

Get in touch

Jurie Schoeman

BSG Chief Executive Officer

jurie.schoeman@bsg.co.za

(+27) 083 30 27169

(+27) 011 215 6666

Read related case studies here:

* Using data science to provide actionable insights for the financial behaviour of bank customers

* Harnessing news media insights to identify valuable business opportunities

* Driving the acquisition and retention of SME customers to unlock potential revenue growth of 12% in the segment

* Understanding customer switching behaviour in the banking environment to actively drive growth

About the author

Jurie Schoeman, BSG Chief Executive Officer

Jurie Schoeman is the CEO of BSG, a homegrown South Africa consulting and technology company that helps business and technology leaders to work together to solve their most important business problems.

Schoeman has more than 19 years' experience in the consulting industry across a diverse range of client industries and roles. He joined BSG in 2007 after seven years with Accenture, and headed numerous key areas during his tenure, before taking over as CEO in early 2018.

Schoeman holds a bachelor's degree in Business Science and Economics, with Honour's in Information Systems from the University of Cape Town in 1999, and continues to prioritise ongoing learning and development.

In Schoeman, BSG has a dynamic leader who believes in growing the business through data-led approaches that allows BSG to provide their clients with the insights and solutions that allow them to give their customers what they need, while continuing to progress BSG's already strong people culture foundation.

Share

Editorial contacts