The acquisition of Lexmark and the EU charge against Google were the highlights of the international ICT market last week.

At home, the talks between Prescient and Stella; and Iron Mountain's acquisition of Docufile, were the main local stories.

Key local news of the past week

* Good year-end figures from Datacentrix, with revenue up 16% and profit up 18%.

* A positive trading update from Amecor.

* A mixed trading update from MTN.

* Little River Trading 264 acquired certain immovable property of IST Holdings, part of the Altron Group, for R102 million.

* ORBCOMM, a global provider of M2M and IOT solutions, bought Skygistics, a South African provider of advanced satellite and GSM communication systems for the control and management of remote assets.

* Iron Mountain purchased a controlling interest (75%) in Docufile South Africa, the largest privately owned records management company in SA.

* New JSE cautionaries by Prescient and Stella Capital partners.

* Renewed JSE cautionaries by Blue Label Telecoms and Huge Group.

* The appointment of Fourie van der Merwe as MD of Bytes Managed Solutions, part of the Altron Group.

* The resignations of Deidre Le Hanie, MD of Bytes Managed Solutions; and Zami Nkosi, CEO of the USAASA (end of contract).

Key African news

* Five telecoms operators, including SA's MTN and Telkom, have designs on a new, superfast submarine cable system connecting Africa, including SA, with the Middle East (and onward to Europe) and South-Central Asia. The cable system to be known as Africa-1 and its backers hope to have it in service by the third quarter of next year.

* Networks Unlimited has opened an office in Mauritius.

Key international news

Microsoft and Alphabet's Google have reached a deal to withdraw all the regulatory complaints against each other.

* A consortium, led by China-based Apex Technology and Asia-focused PAG Asia Capital and including Legend Capital Management, acquired Lexmark International for $3.6 billion.

* Magic Leap, a US start-up working on a device that simulates reality, bought Israeli cyber security company, NorthBit, in a move designed to bolster its advanced software research.

* OpenText will acquire certain customer experience software and services assets from HP, including HP TeamSite, a modern multi-channel digital experience management platform for Web content management.

* Pinterest bought British design app Curator, its 10th acquisition.

* Qorvo, a leading provider of core technologies and RF solutions for mobile, infrastructure and defence applications, purchased privately held GreenPeak Technologies, a leader in ultra-low power, short range RF communication technology.

* Sabre acquired Airpas Aviation, a leading provider of real-time route profitability and cost management solutions for the commercial airline industry.

* Verizon Communications and Hearst bought Complex Media, part of the companies' combined efforts to attract younger viewers to their online programming. The deal was worth $300 million.

* Verizon Communications' AOL acquired virtual reality and 360-degree video company RYOT Corporation.

* Orange made a 65% investment in France-based Groupama Banque that it will transform into Orange Bank.

* The following patent and lawsuit activity:

* Microsoft and Alphabet's Google have reached a deal to withdraw all the regulatory complaints against each other.

* Accenture and Apax Partners, a leading global private equity firm, have agreed to form a joint venture to accelerate the innovation of claims, billing and policy administration software for the insurance industry.

* The EU has charged Google with monopoly abuse regarding its mobile operating system, Android.

* TeliaSonera has rebranded itself as Telia Company.

* Tata Consultancy Services said there was no infringement of Epic System's intellectual property and that it will appeal, after a US jury slapped a $940 million judgment against the IT firm and Tata America International Corporation for stealing trade secrets.

* Good quarterly numbers from Alphabet, ARM Holdings, Manhattan Associates and Netflix.

* Satisfactory quarterly results from ASML Holding, Celestica, Check Point Software Technologies, Citrix Systems, China Mobile, Intel, Linear Technology, SAP, Saudi Telecom, Snap-On, Syntel and Verizon Communications.

* Mediocre quarterly results from Benchmark Electronics, IBM, Lam Research, Microsoft, Rambus and TE Connectivity.

* Mixed quarterly figures from Alliance Data, with revenue up but profit down; CalAmp, with revenue up but profit down; CoreLogic, with revenue up but profit down; Crown Castle International, with revenue up but profit down; DST Systems, with revenue up but profit down; EFI, with revenue up but profit down; EMC, with revenue down but profit up; Ericsson, with revenue down but profit up; F5 Networks, with revenue up but profit down; Fairchild Semiconductor, with revenue down but profit up; Maxim Integrated Products, with revenue down but profit up; Qualcomm, with revenue down but profit up; Rogers Communications, with revenue up but profit down; VMware, with revenue up but profit down; and Wipro, with revenue up but profit down.

* Mixed year-end figures from Powerchip, with revenue up but profit down.

* Quarterly losses from AMD, Mellanox Technologies, Proofpoint, PTC, ServiceNow, Unisys and Zhone Technologies.

* The death of Silicon Valley veteran Bill Campbell, who advised tech leaders including Apple's Steve Jobs and Amazon.com's Jeff Bezos. Campbell was chief executive of Intuit from 1994 to 1998 and again for a few months until January 2000. He retired in January this year as the company's chairman, a post he had held since 1998.

* A disappointing IPO on Nasdaq by Dell's SecureWorks.

Research results and predictions

* EMEA/Africa:

* PC shipments in EMEA totalled 19.5 million units in Q116, a 10% decline from Q115, according to Gartner.

* Worldwide:

* According to IDC's MarketScape Worldwide Cloud Professional Services 2016 Vendor Assessment, which evaluated the offerings and prospects of 17 vendors' relative capabilities and strategies, the following were positioned in the leaders segment: Accenture, Deloitte, HCL, IBM, NTT DATA, and PwC.

* Worldwide shipments of virtual reality hardware will skyrocket in 2016, with total volumes reaching 9.6 million units, according to IDC. Led by key products from Samsung, Sony, HTC, and Oculus, the category should generate hardware revenue of approximately $2.3 billion in 2016.

Stock market changes

* JSE All share index: Down 0.2%

* Nasdaq: Down 0.6%

* NYSE (Dow): Up 0.6% (highest weekend close this year)

* S&P 500: Up 0.5% (highest weekend close this year)

* FTSE100: Down 0.5%

* DAX: Up 3.2%

* Nikkei225: Up 4.3%

* Hang Seng: Up 0.7%

* Shanghai: Down 3.9%

Look out for

* International:

* Further developments regarding the acquisition of Yahoo, with Verizon a favourite for the 'short list'.

* South Africa:

* Further news regarding a possible Vodacom/Infraco deal.

* The outcome of the discussions between Prescient and Stella Capital Partners.

Final word

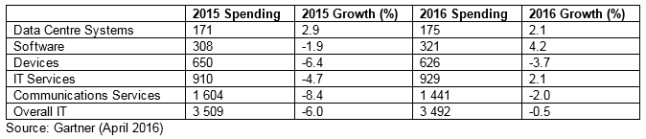

Gartner's latest forecast shows worldwide IT spending is expected to total $3.49 trillion in 2016, a 0.5% decrease over the 2015 spending of $3.51 trillion.

Worldwide IT spending forecast ($bn)

Share