There will be two million 5G subscriptions in Sub-Saharan Africa by 2023.

This is according to Eva Andren, head of managed services for Ericsson Middle East and Africa (MEA), speaking at a roundtable on the side-lines of the AfricaCom 2017 conference in Cape Town.

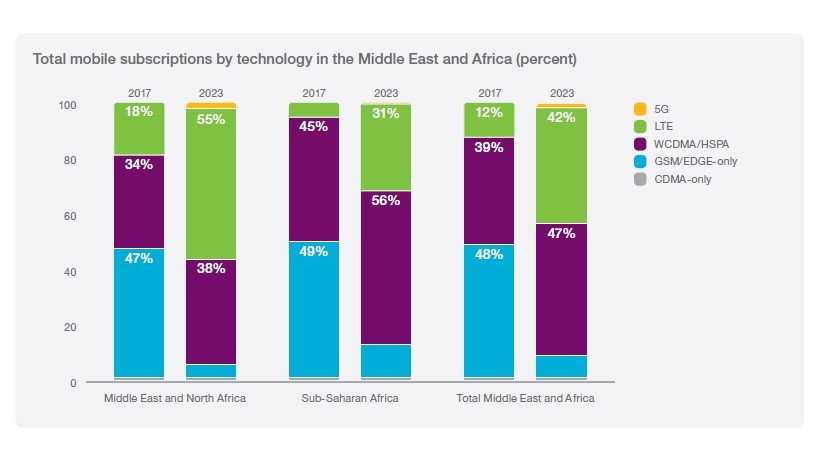

LTE subscriptions will expand by 47% from 30 million in 2017 to 310 million by 2023 in Sub-Saharan Africa, according to forecasts from the upcoming Ericsson Mobility Report 2017.

The latest regional appendix focusing on MEA was unveiled by Ericsson execs at the roundtable and Andren said by 2022, we can expect "the 5G explosion" to reach Sub-Saharan Africa.

Andren said between 2017 and 2023, "LTE will gradually take over but GSM and EDGE will continue to be relevant over this period. Near the end, we will see the growth of 5G coming in, to enable the possibilities of the Internet of things (IOT), especially growth in the market in agriculture, healthcare and also in education."

In comparison, however, the first 5G subscriptions in the Middle East and North Africa are expected from 2020, reaching a total of around 17 million subscriptions by the end of 2023.

The report also announces that overall mobile subscriptions in Sub-Saharan Africa are expected to grow by 6%, between 2017 and 2023, from 700 million to 990 million subscriptions. Mobile subscriptions for the total MEA region are expected to grow at 4% compound annual growth rate (CAGR), from 1.59 billion in 2017 to 2.03 billion by 2023.

Andren said the report reveals astonishing growth numbers for Africa's mobile landscape.

"The uptake and the growth will depend very much on the affordability of smartphones. That is what we are seeing globally and what has really been the big game-changer. So that is going to dictate the pace of change going forward," she told ITWeb.

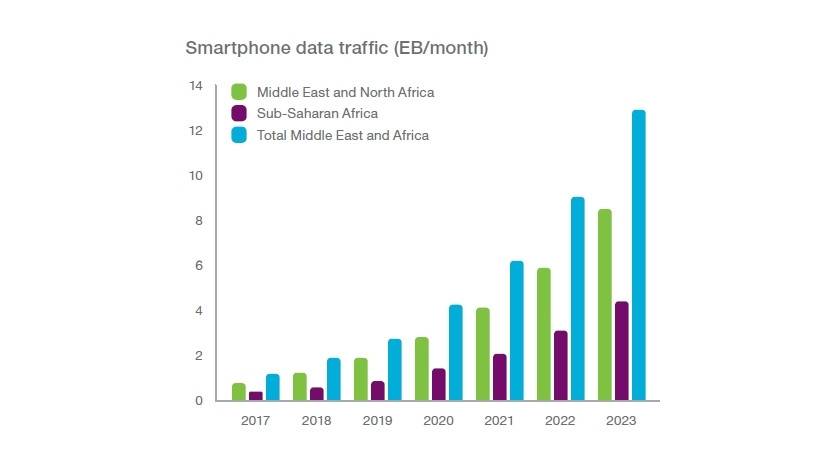

"Total mobile traffic for the region is forecast to grow by around 49% annually between 2017 and 2023. This rapid growth is seeing operators increasingly exploring methods of optimising their networks with more capacity and coverage," said Rafiah Ibrahim, head of Ericsson MEA.

Ericsson predicts mobile broadband subscriptions will grow by 15% for the MEA region from 820 million this year to 1.85 billion by 2023. Sub-Saharan Africa mobile broadband subscriptions are forecast to grow by 16% from 350 million to 880 million by 2023.

When it comes to LTE subscriptions, the MEA region is expected to grow by 29% from 190 million to 860 million by 2023, of which 310 million will be in Sub-Saharan Africa.

IOT and 5G serving communities

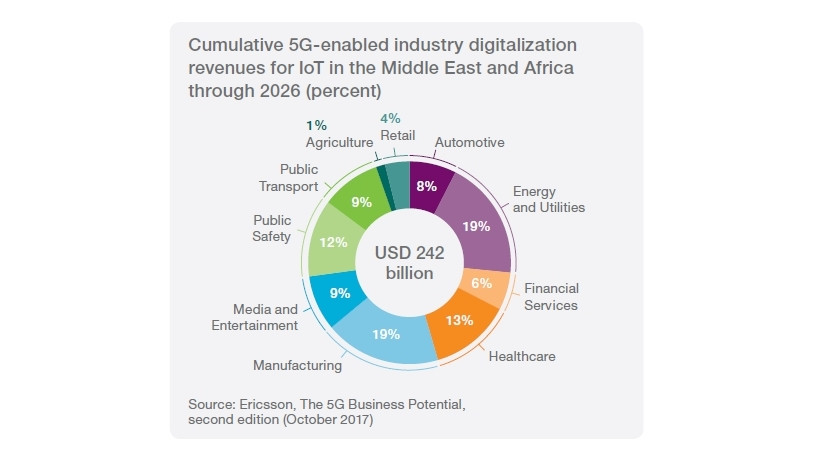

IOT is facilitating the digital transformation of industries, and providing mobile operators in the Middle East and Sub-Saharan Africa with opportunities to explore new revenue streams, Ericsson said. MEA cellular IOT subscriptions are expected to grow from 35 million to 159 million between 2017 and 2023 - a CAGR of around 30%.

"Even though IOT is still in its infancy throughout most parts of the Middle East and Africa, there are still examples of how it has helped improve the livelihood of communities and industries in the region," the report says.

For example, in SA, Narrowband-IOT is being introduced to address the utilities sector, enabling tools for energy-efficiency such as smart meters.

"For mobile service providers, traditional revenue sources are shrinking, and so new revenue streams are being explored. As the world becomes more connected, industries are experiencing an ICT-driven transformation. Industry digitalisation revenues for ICT players come from adopting or integrating digital technologies into a specific industry," the report says.

Ericsson noted 5G will be an important technology in growing industrial digitalisation, particularly for use cases dependent on extra-low latency and high reliability. This presents an opportunity for service providers that are ready to explore smart revenue streams addressing B2B2X industry players.

5G-enabled industry digitalisation revenues for IOT in MEA are predicted to reach $242 billion through 2026.

When asked which country in Africa will see 5G deployed first, Nicolas Blixell, head of the customer unit for West Africa at Ericsson MEA, said the easy predictions would be Kenya, SA and Nigeria but "it could be surprising".

"It depends very much on the application and the sector. I see agriculture as a sector that could see a lot of uptake on 5G, but also on 4G as a plug-in. If you look at LTE-Advanced in Angola it's one of the fastest networks in the world, so I've been surprised before," Blixell said.

Jonathan Adams, head of the customer unit for South and East Africa at Ericsson MEA, says 5G deployments will depend very much on customers and investments but also highlighted South Africa and Nigeria as two possible front-runners.

The global edition of the Ericsson Mobility Report will be released later this month.

Share